Undoubtedly, real estate investments have been an excellent way to grow wealth and generate passive income. However, the traditional methods of investing in real estate can be limiting for many individuals due to the high upfront costs and limited control over investment decisions.

Toc

This is where real estate syndication comes in as a powerful tool for investors looking to diversify their portfolio and increase their potential returns. In this guide, we will explore what real estate syndication is, how it works, and why it’s a game-changer for savvy investors.

Introduction to Real Estate Syndication

Real estate syndication is gaining traction as a powerful investment strategy for savvy investors looking to diversify their portfolios and access larger, more profitable deals. In essence, real estate syndication involves pooling capital from multiple investors to acquire and manage real estate properties that would otherwise be beyond the reach of individual investors.

Whether you’re a seasoned real estate investor or just starting out, understanding the ins and outs of real estate syndication can open up new opportunities for significant returns and passive income.

What is Real Estate Syndication?

Simply put, real estate syndication involves pooling together funds from multiple investors to acquire or develop a property. The group of investors, also known as a syndicate, works together to make decisions regarding the investment, such as property selection, financing options, and management strategies.

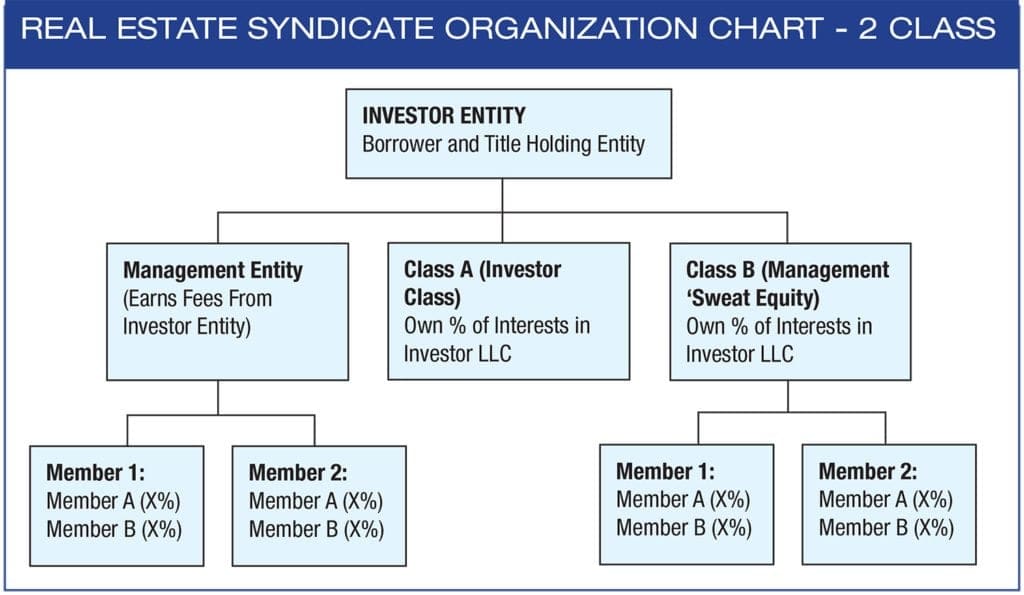

Real estate syndication is typically led by an experienced sponsor or general partner who sources the deals, negotiates terms with lenders and manages the day-to-day operations of the investment. The investors, also known as limited partners, provide capital but have limited involvement in the decision-making process. In return for their investment, they receive a share of the profits generated from the property.

How Real Estate Syndication Works

Real estate syndication involves several steps, starting with identifying a profitable real estate deal that requires significant capital. Once the sponsor has identified a potential property, they create a private placement memorandum (PPM) outlining the details of the investment opportunity for potential investors.

The PPM includes information such as the investment structure, projected returns, risks involved and the roles and responsibilities of each party. Investors who are interested in the deal can then review the PPM and decide whether to invest in the syndication or not.

Once enough capital has been raised from interested investors, the sponsor acquires or develops the property using a combination of investor funds and financing options such as bank loans or private equity.

Throughout the lifespan of the investment, the sponsor manages day-to-day operations such as tenant management, property maintenance and financial reporting. The limited partners receive regular updates

The Roles of Syndicators and Investors

In a real estate syndication deal, there are typically two main parties involved:

- Syndicators (or Sponsors): These are the individuals or companies responsible for sourcing the property, securing financing, and managing the investment. Syndicators bring expertise and experience to the table, ensuring that the property is acquired, managed, and eventually sold at a profit.

- Investors: These are the individuals or entities that provide the capital needed to acquire the property. In return for their investment, they receive a share of the profits generated by the property, typically in the form of rental income and appreciation. Investors have limited involvement in the day-to-day operations of the investment, but they do have a say in major decisions through voting rights outlined in the PPM.

Why Real Estate Syndication is a Game-Changer

Real estate syndication offers numerous benefits for both syndicators and investors, making it an attractive investment option:

Diversification

One of the primary advantages of real estate syndication is the ability to diversify an investment portfolio. By pooling resources with other investors, individuals can access a variety of properties across different markets and asset classes, reducing risk while potentially increasing returns. This diversification is particularly advantageous in real estate, where market conditions can vary significantly by location and property type. Instead of relying solely on a single investment, syndication allows investors to participate in multiple projects, spreading their risk and enhancing the overall stability of their portfolio.

Access to Larger Deals

Real estate syndication opens the door to larger, more lucrative deals that may be unattainable for individual investors. By combining resources with others, investors can participate in commercial properties, multi-family units, and other high-value investments that typically require substantial capital. This access not only increases potential returns but also allows investors to benefit from the appreciation and cash flow produced by these larger investments.

Professional Management

Another significant benefit of real estate syndication is the professional management provided by syndicators. Experienced sponsors bring valuable market knowledge and operational expertise, ensuring that the property is well-managed and that investor interests are prioritized. This professional oversight can lead to improved property performance, maximising both rental income and overall returns for investors. By engaging in a syndication, investors can enjoy the benefits of real estate investing without the stress of daily management responsibilities.

Passive Income

One of the most appealing aspects of real estate syndication is the potential for passive income. Investors can earn returns on their investments without the hands-on involvement typically associated with traditional real estate ownership. This means that while the syndicator manages the property and addresses on-the-ground issues, investors can focus on their day-to-day lives without the burden of property management. This income generally comes from rental payments made by tenants, which are distributed among the investors after operating expenses and management fees are covered. Additionally, many syndications also offer profit distributions upon property sales, leading to capital appreciation. For investors seeking to create a steady stream of income or build wealth over time, real estate syndication presents a compelling opportunity to combine investment with a more relaxed lifestyle.

Higher Returns

Real estate syndication often provides investors with opportunities for higher returns compared to traditional investment avenues. By leveraging the expertise of syndicators who understand market dynamics, identify undervalued properties, and implement effective value-add strategies, syndications can enhance the overall return on investment. The combination of cash flow from rental income and potential future appreciation of the property can yield annual returns that often exceed those available through other assets such as stocks or bonds. Additionally, the economies of scale achieved through pooling funds can lead to reduced costs and higher profitability, benefiting all investors involved. This alignment of interest between syndicators and investors further drives performance, as syndicators typically invest their own capital alongside that of investors, motivating them to maximise returns while maintaining a rigorous focus on risk management.

The Process of Acquiring and Managing Properties

The syndication process generally follows these steps:

Property Identification

The first step in the syndication process is identifying a suitable property that meets the investment criteria set by the syndicators and investors. This involves thorough market research and analysis to pinpoint locations and property types with growth potential. Factors such as economic indicators, demographic trends, and comparable sales are considered to assess whether the property can yield strong returns. Syndicators often leverage their industry networks, data analytics tools, and local knowledge to find properties that align with the syndicate’s investment strategy.

Due Diligence

Once a property is identified, extensive due diligence is conducted to evaluate its financial performance, physical condition, and legal standing. This process includes inspecting the property, reviewing financial statements, assessing potential risks, and verifying zoning regulations. The goal of due diligence is to ensure that the property can meet the expectations set out in the offering materials and that there are no hidden issues that could adversely affect the investment. This comprehensive analysis helps investors make informed decisions and provides confidence in the investment’s viability.

Securing Financing

After completing due diligence and receiving investor approval, the next step is to secure financing for the property acquisition. Syndicators typically explore various funding options, which may include traditional bank loans, private equity, or a combination of both. The financing structure can significantly impact the investment’s returns, so meticulous planning is essential. Once financing is secured, the syndicator proceeds with the acquisition, finalizing the purchase agreement and executing necessary legal documents.

Property Management

Post-acquisition, the syndicator takes charge of property management, focusing on maintaining operational efficiency and maximising profitability. This includes tenant placement, rent collection, property maintenance, and ongoing communication with investors. Effective management plays a crucial role in ensuring that the investment continues to perform optimally, thereby enhancing cash flow and safeguarding investor interests. Regular updates and performance reports are provided to investors, allowing them to stay informed about the investment’s progress and financial health.

Exit Strategy

Finally, a well-defined exit strategy is essential for maximising returns. The syndicator and investors work together to establish criteria for when to sell the property, which may depend on market conditions, property performance, or investment objectives. The goal is to capitalize on appreciation and ensure a successful return on investment for all parties involved. By carefully planning the exit strategy throughout the investment lifecycle, syndicators can add significant value and drive enhanced profitability for their investors.

Real-Life Examples of Successful Syndication Deals

There are many successful real estate syndication deals that have generated substantial returns for investors.

The High Line Tower: A Real Estate Syndication Success Story

A group of investors used syndication to fund the acquisition and development of a luxury residential tower near New York City’s High Line. The project resulted in significant profits and maintained high occupancy rates, showcasing the potential of well-executed syndication deals.

Tech Park Venture: Real Estate Syndication for Commercial Spaces

A collaboration between a syndication group and a technology park developer led to the construction of a state-of-the-art office complex. Investors enjoyed attractive returns, and the project positively impacted the local tech industry.

Beachfront Bliss: Real Estate Syndication in Vacation Properties

Syndication was used to purchase and operate a series of beachfront vacation homes. Investors benefited from seasonal rental income and property appreciation while avoiding the challenges of individual property management.

Urban Renewal Project: Redeveloping Historic Buildings via Syndication

A team of investors revitalized a downtown area by acquiring and renovating several historic buildings. The project created trendy mixed-use spaces and contributed to the community’s economic growth. Investors received a steady stream of rental income and substantial returns upon exit.

How to Get Started in Real Estate Syndication

If you are interested in real estate syndication, here are some steps to get started:

Steps for Syndicators

- Build a Network: Establish connections with potential investors, real estate agents, and other industry professionals.

- Identify Opportunities: Conduct thorough market research to find viable properties for syndication.

- Create a Business Plan: Outline your strategy, financial projections, and management plan to present to potential investors.

- Secure Financing: Obtain the necessary funding through investor contributions and external financing.

- Execute and Manage: Oversee the acquisition, management, and eventual sale of the property.

Steps for Investors

- Research Syndicators: Look for experienced syndicators with a proven track record of successful deals.

- Assess Opportunities: Evaluate the investment opportunities presented to you, considering the property’s potential and associated risks.

- Commit Capital: Once you’ve chosen a syndication deal, commit your capital according to the terms outlined by the syndicator.

- Stay Informed: Maintain regular communication with the syndicator and stay updated on the property’s performance.

Common Challenges and How to Overcome Them

- Lack of Experience: New syndicators should consider partnering with experienced professionals to build credibility and expertise.

- Finding Investors: Networking and building relationships within the real estate community can help attract potential investors.

- Regulatory Compliance: Ensure that all legal and regulatory requirements are met to avoid potential issues. Seeking professional advice may be beneficial.

- Market Volatility: Conduct thorough due diligence and have contingency plans in place to mitigate risks associated with market fluctuations. Regular performance monitoring is crucial.

Conclusion

In conclusion, real estate syndication offers a powerful avenue for both syndicators and investors to achieve significant financial success through collaborative efforts in property investment. By understanding the structured process—from acquisition to management and eventual exit strategies—participants can cultivate a profitable portfolio while sharing risks and resources. The examples highlighted demonstrate the diverse opportunities within this investment model, ranging from residential developments to commercial projects. As the real estate landscape continues to evolve, staying informed and adaptable will be crucial for both syndicators and investors looking to harness the potential of syndication as a viable investment strategy. With proper planning, thorough research, and effective management, real estate syndication can become a fruitful venture for all parties involved.